St. Martin de Porres, Salvation Army to benefit from $20m in New Market Tax Credits

The proposed new St. Martin de Porres High School in the St. Clair neighborhood and the Salvation Army's $35 million capital campaign for greater Cleveland will each receive $10 million in Federal New Market Tax Credits, which are part of a $50 million award the Cleveland Development Advisors (CDA) are shepherding on behalf of the city. The award was announced in June.

"At any given time we might have a dozen projects on the list that are close to or getting ripe for investment," says CDA president Yvette Ittu. "Once we get allocation we start moving very quickly to try to move those projects to fruition."

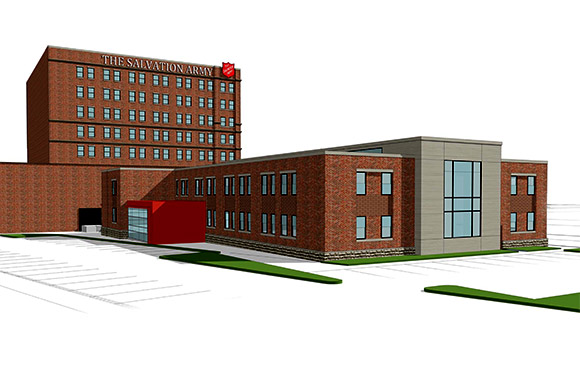

The Salvation Army campaign includes a new family shelter downtown, new community centers in Collinwood and East Cleveland and the renovation of a community center in West Park. The new 65,000-square-foot St. Martin de Porres High School will be at the intersection of Norwood Road and St. Clair Avenue.

As for the remaining $30 million in tax credits to be allocated, Ittu said plans have not been formalized, but hinted that the awards will go to a handful of high profile projects that are ready to move. Per the United States Treasury, the group has up to three years to allocate the tax credits, but CDA does not act leisurely when placing allocations.

"Our awards are generally out the door in less than 12 months," says Ittu.

In the program, entities such as CDA court private investment for local projects, particularly in low-income areas. Investors are rewarded with federal tax credits.

"The tax credit is not applied to the actual project," explains Ittu. "What we're doing is providing a tax credit to an investor who is bringing the capital to the table. It could be a bank or corporation that has the need for a tax credit. Maybe they are willing to invest X amount of dollars into a project in return for the tax credit." Funds must be spent on a project before the investor can reap the tax credits, which may be taken over a seven-year period.

The nature of the program makes for strange bedfellows: Goldman Sachs, for instance, was a satellite investor in the Fairmont Creamery project courtesy of New Market Tax Credits.

CDA, which Ittu describes as a real estate financing organization affiliated with the Greater Cleveland Partnership, selects candidates based on recommendations from its Community Advisory Committee. The group focuses on areas of severe economic distress with unemployment rates more than 1.5 times the national average, poverty rates of 30 percent or more, or median incomes at or below 60 percent of the area median. Considerations also include timing of the project, its readiness for financing, its sustainability and its economic impact.

"A lot of what we do is looking to try to invest in projects that will stimulate additional development and also create jobs," says Ittu.

Specific goals include affordable housing, healthy food accessibility, public transit access and repurposing vacant structures. The group's success can be measured in their results. Including this year's $50 million award, the CDA has received $155 million in New Market Tax Credits since the program's inception in 2003. They have helped finance more than 30 projects including The 9, the Lutheran Metropolitan Ministry's Richard Sering Center, the Residences at 1717 and renovations at Saint Luke's Pointe.