Cleveland healthcare companies attracted more than $200 million in new investment last year

Midwest Healthcare Growth Capital Report

Midwest Healthcare Growth Capital Report

Those with an eye on local healthcare-based technology maintain that Cleveland is emerging as a powerful base for medical know-how. For proof of this trend, observers point to the latest Midwest Healthcare Growth Capital Report.

Last year, Cleveland's healthcare industry attracted $201 million in new investments across 34 companies in the areas of medical devices, biopharmaceuticals and healthcare IT, according to the report released Feb. 17 by BioEnterprise. Cleveland ranked third in health-tech funding among major Midwest cities, trailing only Minneapolis ($418 million) and Chicago ($217 million).

"We have a wonderful foundation of biomedical-driven innovation," says BioEnterprise CEO Aram Nerpouni. "There's a critical mass developing."

2015 marked the fourth consecutive year that Cleveland garnered more than $200 million in biomedical investment activity, Nerpouni notes. In that time frame, Northeast Ohio healthcare firms have raised more than $1 billion.

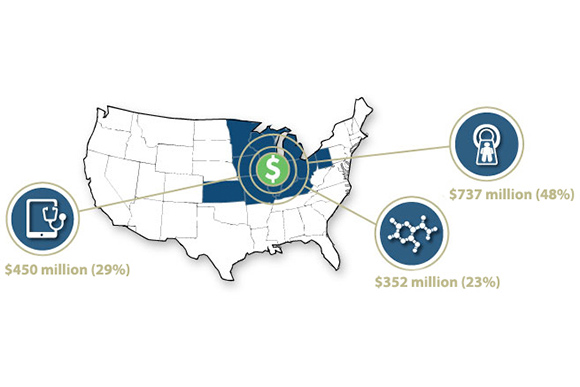

The overall increase is in response to a burgeoning research base as well as funding from local and national investors and state sources like the Ohio Third Frontier program, Nerpouni says. Northeast Ohio's recent success helped place the Buckeye State second overall ($331 million) among Midwestern states that regionally attracted $1.5 billion in healthcare investment last year.

Not mentioned in the report was record Cleveland-area acquisition activity valued at more than $4 billion, says the BioEnterprise official. The two largest gains during 2015 were Steris's $1.9 billion purchase of British company Synergy Health and Rite Aid/Walgreens acquiring pharmaceutical firm EnvisionRX as part of a $2 billion deal. In addition, medical device company CardioInsight was bought by Medtronic, while health IT business Explorys was brought into IBM.

"Companies (like Steris) that grew up here are starting to make their own acquisitions in other places," says Nerpouni. "It's a sign of the overall robustness and maturity of the industry."

Though the numbers are impressive, work is required to bring additional investment to the area's early-stage biomedical companies, Nerpouni says. While local investors may wary about sinking money in younger firms, programs like Ohio Third Frontier are offering pre-seed funding to accelerate the growth of startup tech-based enterprises.

Nerpouni expects more dollars to flow in as the region's healthcare sector continues to establish itself. "All the ingredients are there," he says.