LendULink helps parents secure college loans at better rates

As a business student at the Ohio State University, Steve Muszynski began thinking about the loans his parents had taken to pay for his college education, and his sister’s schooling before him. While the loans have been paid back and Muszynski’s parents had planned for them, it made him start thinking about how parents pay for their kids’ education.

Muszynski graduated and went to work for General Electric’s financial management program. But he kept thinking about the struggles parents and students go through to pay back the trillions of dollars in student loans taken out each year.

“The interest rate on college loans is about nine percent,” says Muszynski. “Only 11 percent of households have savings for college and 42 percent of households are saving in a regular bank account.”

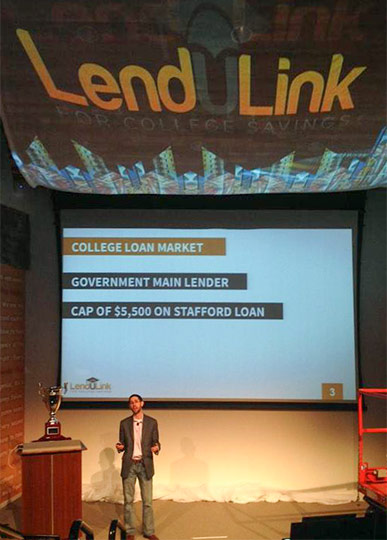

Steven MuszynskiMuszynski started thinking that there had to be a better way to pay for college. He did just that when he formed LendULink in 2013. “Two years ago I left GE wondering, if a lender knew you’d pay back your loan, would you get a better rate,” he says. He formed the company, enrolled in Bizdom’s accelerator program and has been growing LendULink ever since.

Steven MuszynskiMuszynski started thinking that there had to be a better way to pay for college. He did just that when he formed LendULink in 2013. “Two years ago I left GE wondering, if a lender knew you’d pay back your loan, would you get a better rate,” he says. He formed the company, enrolled in Bizdom’s accelerator program and has been growing LendULink ever since.

LendULink offers the only college savings account in the country that pre-qualifies households for low interest rate future college loans.

LendULink offers two deposit-model savings programs. Participants make monthly deposits -- $300 for the two-year program and $500 for the one-year program – to pre-qualify for a low interest rate on a college loan. Savers must keep a minimum balance in the account, but they can access their money at any time otherwise.

While there are government 529 accounts – tax-free government college savings accounts – the money can’t be touched if you need it. “529s are recognized as the best way to save for a child’s college education, and I agree,” says Muszynski. But 529s are most effective if parents start when the kids are young. LendULink’s programs are designed for parents who start saving in their kids’ teen years.

“We’re the only program geared toward the parents who are saving when the kids are in high school,” says Muszynski. “Business has been good, but with challenges because we are really pioneering a new space: when the kid is in high school, parents are having that ‘oh crap’ moment. Our target is to help parents pay for college education.”

Muszysnki admits it’s been a challenge finding banks for the program, but he says at least a couple of banks are coming on in the next month, with even more by the end of the year. He says demand from investors has been high and LendULink is popular in the credit unions.

LendULink recently received a $25,000 grant from The Innovation Fund, which awards money to technology-based entrepreneurial businesses in Northeast Ohio. “We will be using the funds for technology development on our CollegePricer product, which projects out a user’s future financial aid package for almost any college using a user’s own financial circumstances,” says Muszynski. “This tool will really help families compare the true cost of college.”